[DBJ article] More education doesn’t always mean bigger paychecks for Texas women

July 22, 2020

Elizeth Diaz has worked hard for many years toward her bachelor’s degree in psychology, and she looks forward to graduating in August from Dallas Baptist University.

Elizeth Diaz has worked hard for many years toward her bachelor’s degree in psychology, and she looks forward to graduating in August from Dallas Baptist University.

But with $60,000 in student loan debt, an 8-year-old daughter, a 4-year-old son, and graduation date in the midst of a pandemic-induced recession, the 32-year-old is justifiably concerned about her future.

“I am worried,” Diaz said. “Once August comes and I receive my degree, I’m going to start paying that off. I have to find a job and get paid enough so that if I have to put my children in a day care, I can, and I will work until I can pay it off.”

High levels of college loan debt and child care issues are two obstacles that women experience more than men in Texas when it comes to getting an education that translates into financial security, according to the recently released third edition of the “Economic Issues for Women in Texas” report by the Dallas-based Texas Women’s Foundation.

Kate Rose Marquez, CEO of the Dallas nonprofit WiNGS, said she thinks education is the biggest challenge to women’s financial security. WiNGS helps women on several fronts, including overcoming poverty and attaining financial security.

Kate Rose Marquez, CEO of the Dallas nonprofit WiNGS, said she thinks education is the biggest challenge to women’s financial security. WiNGS helps women on several fronts, including overcoming poverty and attaining financial security.

“The biggest wage gap (between men and women) is at $35,000 and below,” Marquez said. “It’s almost a 2-to-1 where men make more than women in that salary range, and it closes as it increases. I think education is a huge part of that.”

Among full-time workers in Texas, women earn $10,136 less per year than men on average, the Texas Women’s Foundation study says. And the gender wage gap is persistent. It hasn’t budged over the last decade, according to the report, which is conducted every three years.

Child care is also a big part of the wage gap, Marquez said.

“You end up having women who are often single woman head-of-household and you’ve got them trying to juggle,” she said. “Being a single parent, they’ve got limits on their education.”

Women are at the heart of the student debt crisis, the Texas Women’s Foundation report found. Women owe nearly two-thirds of the roughly $1.4 trillion in outstanding student debt in the United States.

Texas has been slowly reducing public investment in the state’s colleges and universities since 2000, awarding more aid to full-time students attending four year universities and leaving less for part-time students and those attending two-year programs, the report notes.

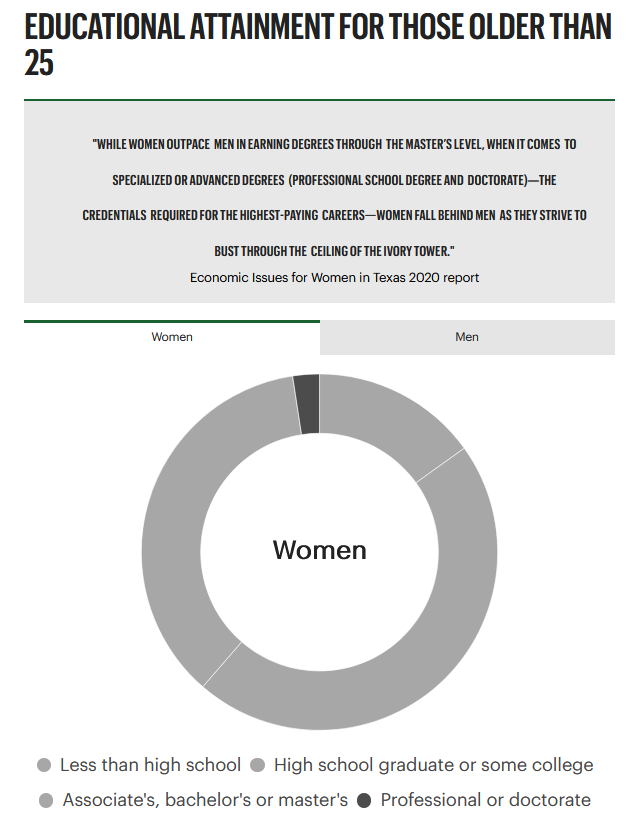

Overall, Texas women are well-educated, with 1.4 times as many women as men completing public college in 2018. Yet Texas women still earn less than men in every occupation, according to the report.

While both Hispanic women and African American women are attending and graduating from college at numbers greater than Black and Hispanic men, Texas still has only 17 percent of Hispanic women and 27 percent of Black women with some sort of post-secondary degree, said Dena Jackson, chief operating officer of Texas Women’s Foundation.

That statistic is going to make it difficult for Texas to reach its “60-by-30” educational goal — 60 percent of Texans having a post-secondary degree by 2030, Jackson said.

Hispanic women are the fastest-growing demographic in the state, Jackson said. There are about 1.2 million more Hispanic women in Texas in 2018 than there were in 2008, which is a 31 percent growth rate, she said.

Hispanic women are the fastest-growing demographic in the state, Jackson said. There are about 1.2 million more Hispanic women in Texas in 2018 than there were in 2008, which is a 31 percent growth rate, she said.

“If you do not continue to invest in the growth of particularly Hispanic families, then we’re never going to be able to succeed at 60-by-30,” she said.

Even though women in Texas are earning college degrees at a rate faster than men, women are earning specialized and advanced degrees at a lower rate than men, factoring into the lower pay for women, according to the report.

Diaz graduated from Duncanville High School in 2006, and her journey to a bachelor’s degree has been a long one.

She attended community college on and off, depending on work and family commitments, got married in 2011, and in 2013 finished her associate’s degree through the Dallas County Community College District.

She and her husband, a welder, have had financial challenges, and most of the child care has fallen to her, Diaz said.

“I stopped (taking classes) because I had to work and also take care of my child and support my husband and my family,” Diaz said. “All through the years of my marriage, I worked, except for now. This year has been different. It has changed due to the virus and a lot of things are going to change for my kid’s education as well.”

Despite her challenges, Diaz remains optimistic and full of faith.

Despite her challenges, Diaz remains optimistic and full of faith.

“I want to give back to the community,” she said. “I want to use my time to serve in an area where God wants me to and provide to families, whether it’s through counseling or through my service.”